Brazil’s currency loses 12% to 13% of its value each year, according to Cauê Oliveira, the Head of Research and on-chain analyst at BlockTrends Brazil.

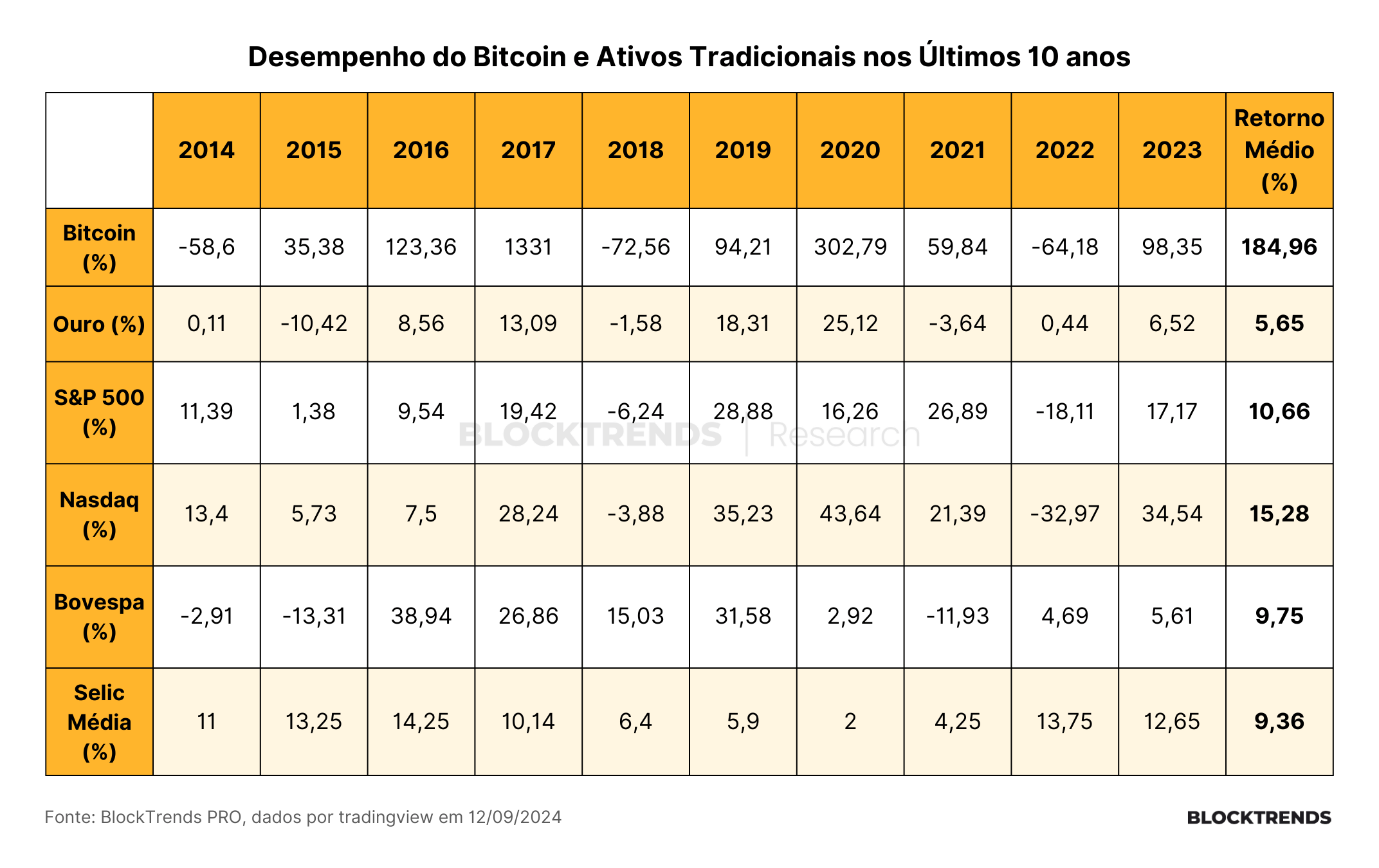

He warns that without assets earning interest or salary growth exceeding this rate, individuals will become poorer annually. Oliveira’s table compares the annual returns of various assets from 2014 to 2023, highlighting investments that can offset this depreciation.

Over the past decade, Bitcoin led with an average annual return of 184.96%, despite significant volatility, including years with negative returns like -58.6% in 2014 and -72.56% in 2018.

Traditionally considered a hedge against inflation, gold averaged a 5.65% return, with its highest annual return at 25.12% in 2020. The S&P 500 and Nasdaq indices showed average yearly returns of 10.66% and 15.28%, respectively, while Brazil’s Bovespa index averaged 9.75%. The Selic rate, Brazil’s benchmark interest rate, averaged 9.36%.

Thus, over the past decade, holding Bitcoin or investing in the Nasdaq are the only two asset classes that would have ensured Brazilians’ wealth did not degrade.

These figures suggest that investing in high-performing assets like Bitcoin may help Brazilian investors combat the loss of purchasing power due to currency devaluation. Oliveira emphasizes the importance of assets earning above the devaluation rate to prevent financial erosion.

The post Bitcoin is the best asset to protect against Brazil’s 13% yearly currency depreciation appeared first on CryptoSlate.