The rise in cryptocurrency-related crime we’ve seen in the past year has been somewhat expected. As the crypto market grows, so does the number of malicious actors that operate in it. And while the share of crypto crime in the overall market has dropped significantly in the past year, it’s still a very lucrative business.

However, cybercriminals operating in the crypto market face a very unique problem—how to hide their ill-gotten funds and convert them to cash.

The transparent nature of blockchain technology means that each and every cryptocurrency transaction made on-chain can be followed. This makes it extremely hard to hide large transactions and easy for law enforcement to follow the flow of stolen cryptocurrencies.

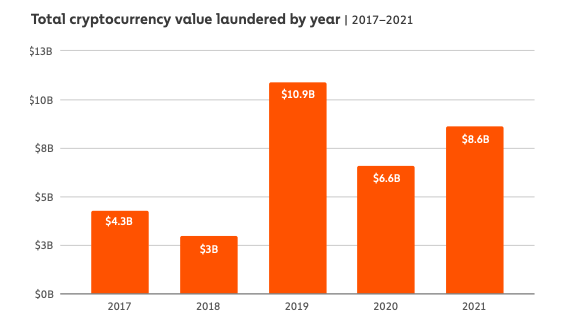

These challenges, however, haven’t stopped cyber criminals from drastically increasing their money laundering efforts last year. According to the Chainalysis 2022 Crypto Crime Report, 2021 saw a 30% increase in money laundering activity over 2020.

Overall, cybercriminals have laundered over $33 billion worth of cryptocurrency since 2017. Last year, money laundering accounted for just 0.05% of all crypto transaction volume.

For comparison, the United Nations Office of Drugs and Crime estimates that between $800 million and $2 trillion of fiat currency is laundered each year—or around 5% of the global GDP.

Laundering stolen funds

The decentralized and anonymous nature of the crypto industry has made it an easy target for governments and market regulators, who claimed that they’re a hot spot for money laundering.

However, data from Chainalysis shows that this is not the case.

Money laundering in the crypto industry is heavily concentrated, with most of it ending up in a surprisingly small group of services, almost all of which are centralized. These services appear to be built specifically for money laundering based on their transaction histories.

Overall, based on the amount of cryptocurrency sent from illicit addresses to addresses hosted by services, criminals have laundered $8.6 billion worth of cryptocurrency in 2021.

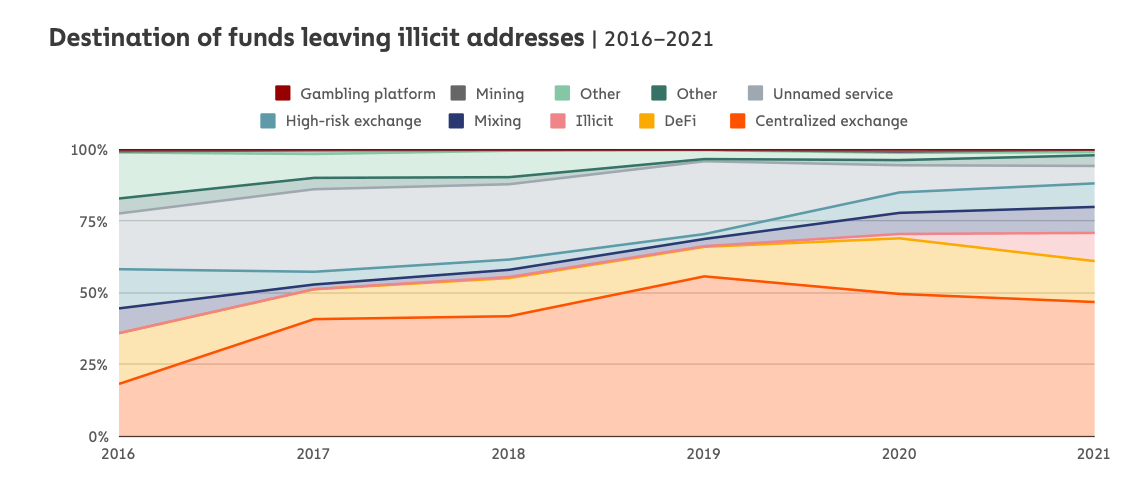

Last year, the biggest share of funds sent by illicit addresses went to centralized exchanges. However, 2021 was the first year since 2018 that centralized exchange didn’t receive the majority of the funds sent by illicit addresses—instead, they took in just 47%.

According to Chainalysis, DeFi protocols received 17% of all funds sent from illicit wallets in 2021, up 2% from the previous year.

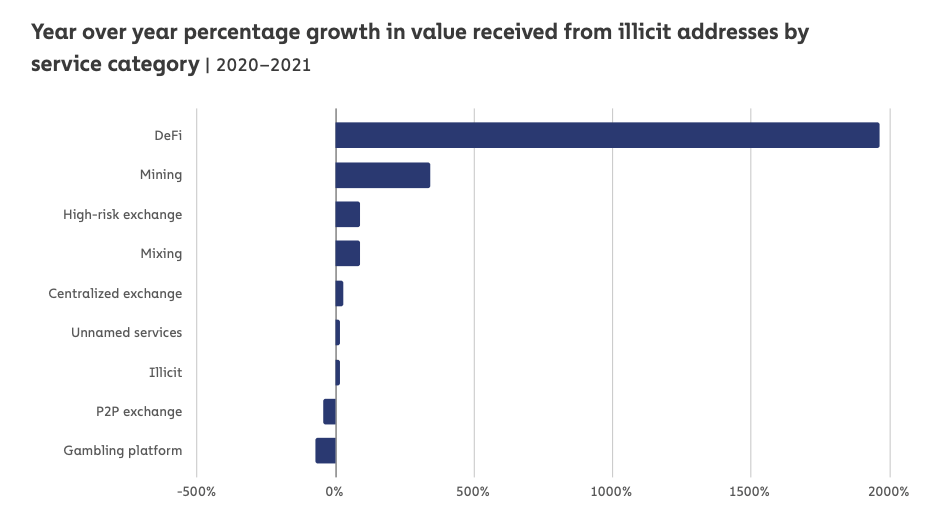

However, while the share of the funds sent to DeFi increased by just 2%, the overall value of funds received by DeFi protocols increased by 1,964% year-over-year. A total of $900 million worth of cryptocurrencies was sent to DeFi protocols from illicit addresses. Mining pools, high-risk exchanges, and mixers also saw substantial increases in value received last year.

Chart showing the year-over-year percentage growth in value received from illicit addresses by service category in 2021 (Source: Chainalysis)

Where illicit addresses send their funds depends largely on how they obtained them in the first place. One thing that stands out in the Chainalysis report is the difference in laundering strategies between the two highest-grossing forms of cryptocurrency crime: theft and scamming.

Addresses associated with theft send just under half of their stolen funds to DeFi platform. Data has shown that over $750 million worth of stolen cryptocurrency was sent to various DeFi protocols to be laundered in 2021. Out of the $750 million, $400 million alone was laundered by North Korea-affiliated hackers.

The increase in the amount of funds laundered through DeFi could, at least in part, be attributed to the fact that more cryptocurrency was stolen from DeFi protocols than any other type of platform last year. Hackers that manage to steal funds this way are also usually very technically skilled, making them more likely to use a complex DeFi protocol to launder their stolen funds.

Scammers, on the other hand, are by default less technically skilled and are more likely to use centralized exchanges to launder money.

Despite the increasing share DeFi has been playing in money laundering, it still remains heavily concentrated to just a few centralized services. In 2021, money laundering concentration appears to have increased, with 58% of all funds sent from illicit addresses ending up in just five services.

However, Chainalysis notes that money laundering activity is better viewed at the deposit level rather than the service level. This is due to the fact that many money laundering services are “nested,” meaning they operate using addresses hosted by larger services.

In its report, the company looked at all service deposit addresses that received any illicit funds in 2021and found that a group of 583 received 54% of all funds sent from illicit addresses in 2021. Each of those 583 addresses received at least $1 million from illicit addresses and, in total, they all received $2.5 billion worth of cryptocurrencies. An even smaller group of 45 addresses received 24% of all illicit funds. One deposit address received just over $200 million, all from wallets associated with the Finiko Ponzi scheme.

And while money laundering activity was quite concentrated in 2021, it’s less so than in 2020. The overall value of funds laundered has increased, but the share money laundering has in the greater crypto market remains minuscule.

The post The Crypto Crime Series: Money laundering underpins all forms of cryptocurrency crime appeared first on CryptoSlate.