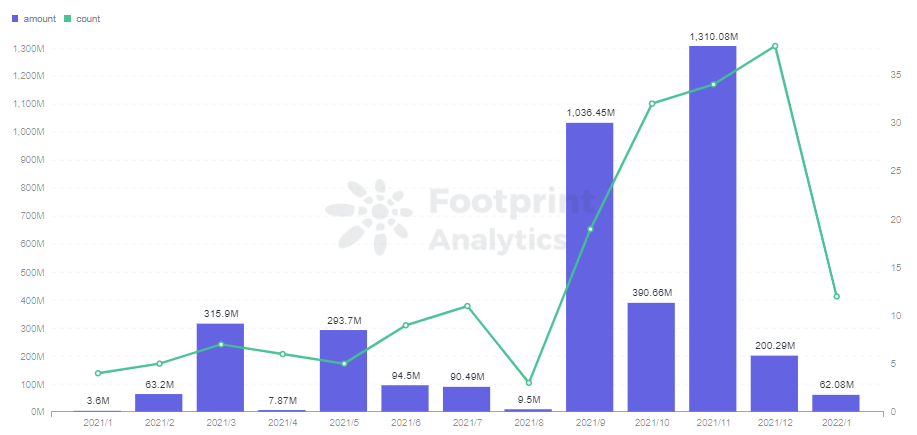

According to Footprint Analytics, the gaming sector has attracted a large number of investors since September, with funding reaching a peak of $1.3 billion in November. GameFi is attracting attention for its short payback period, and the market has been awash with gaming projects since the second half of the year.

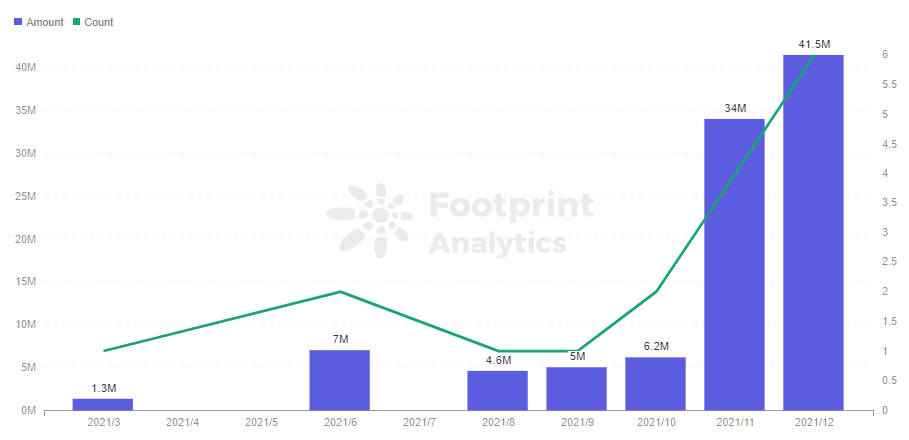

After GameFi’s explosive growth, gaming guilds started to get the attention, with $34 million and $41.5 million raised in November and December. Among VCs that invested in guilds are a16z, DeFiance Capital, Coinbase Ventures, and Animoca Brands.

Guilds are not only a place to communicate about games but to provide players with resources like strategies and equipment. The most well-known guild is Yield Guild Game (YGG).

Although the management and operation of each guild vary, VCs are placing their bets on guilds in the hope of catching the next YGG.

In this article, Footprint Analytics will take a brief look at six notable guilds.

1. Yield Guild Games (Token: YGG)

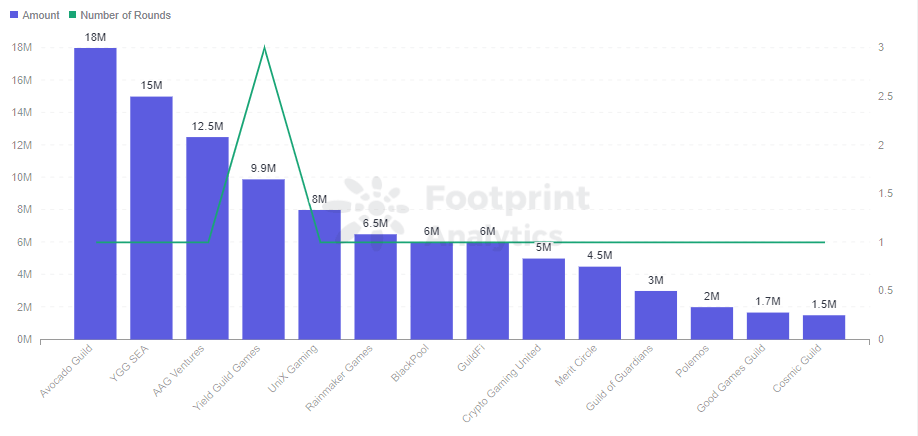

Yield Guild Game (YGG) is currently the guild with the most rounds of funding, with three rounds funded with $9.92 million.

With Axie’s popularity, YGG started the Axie Scholarship program, which provides the 3 necessary Axie NFTs for users to start the game. The guild has built a one-stop gaming hub for recruitment, training, and lending thanks to a profit-sharing model of 70% for players, 20% for middle management, and 10% for later reinvestment in the guild.

YGG has lowered the entry requirements for user participation in GameFi while partnering with more than 30 games, helping them increase their exposure.

To address the geographic boundaries, YGG has also established various regional and branch subDAOs to recruit, train, and localize games, and to integrate talent into DAOs.

Most notably, YGG SEA, one of YGG’s subDAOs focused on Southeast Asia, received up to $15 million in fundraising in December.

Each subDAO can also issue tokens. For example, users holding YGGLOK tokens can vote on how rewards are distributed in the League of Kingdom.

2. Avocado Guild (Token: AVG)

Avocado Guild (AG) was founded in July with a short history of development but is the highest funded guild ($18 million).

Similar to YGG, AG’s core operating platform is Axie, which provides free accounts to players through its Axie Infinity Scholarship Program and generates revenue through education and training in association with AG.

Although AG players only get 50% of the revenue, AG is different from other guilds because of its emphasis on community education. AG proposes 3 new concepts of P2E (Play To Educate, Play To Enrich, Play To Empower) to educate and train players on blockchain knowledge through online and offline communication, encouraging players to study game mechanics and improve their skills.

AG has also partnered with Singaporean telecom provider TPG Telecom, allowing users to exchange AVG (AG’s token) for TPG credits, completing AG’s first case in the real world.

3. GuildFi (Token: GF)

GuildFi (GF) aims to be a metaverse infrastructure portal, positioned as a one-stop service platform for players, guilds, gamers, and investors. By providing entry, training, and value-added services to form a guild across-chains aggregation platform.

GF establishes the identity of players in the metaverse by setting up GuildFi ID, in which players’ achievements on the chain will be recorded.

4. Rainmaker Games (Token: RAIN)

Rainmaker Games aims to build the largest dynamic database of P2E (play-to-earn) games and already has a collection of several hundred.

Rainmaker Games offers three levels of play–entry, intermediate and advanced—and players can choose which level to experience.

5. Merit Circle (Token: MC)

Merit Circle is similar to YGG in that it has the same architecture of a DAO and a subDAO. Instead of issuing a subDAO token, Merit Circle’s subDAO shares a token, MC, with the DAO.

6. Good Games Guild (Token: GGG)

Good Games Guild is focusing on developing an asset dashboard and NFT trading platform to help players manage their assets in various games and build a tool-based Game Hub.

Summary

Both players and game developers benefit from the emergence of guilds. For the developers, it helps to expose the game and increase traffic. For players, it lowers the entry requirement and helps them generate revenue.

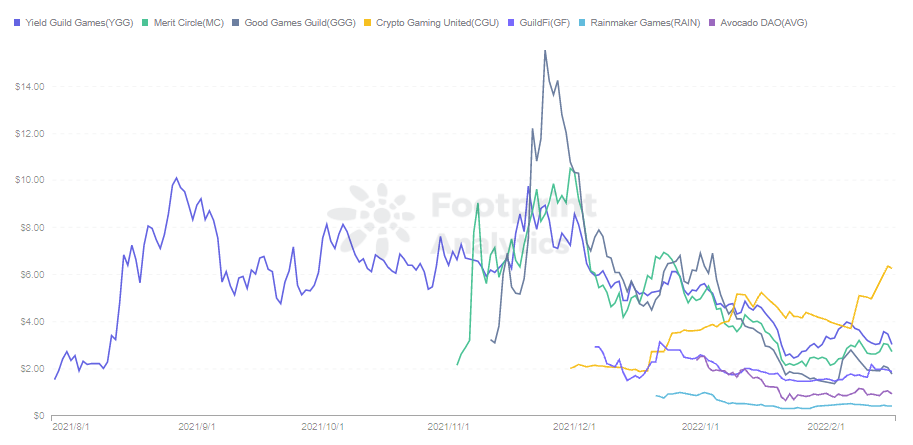

So far, guilds have also implemented the DAO governance model by issuing tokens. According to Footprint Analytics, the price of tokens is below $10. There is still a lot of space for growth. Players holding tokens such as YGG are equivalent to holding index funds for the guild to invest in various P2E projects, and they can also participate in the operation of the community.

The choice of game is critical to the guild. Games that are essentially Ponzi schemes can be very damaging to players and guilds. Even a game like Axie can be negatively impacted by the continued decline in revenue.

From the second half of 2021, we saw a diversification of guild forms, and the next successful guild like YGG is bound to have a different model.

What is Footprint Analytics?

Footprint Analytics is an all-in-one analysis platform to visualize blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects, and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own customized charts in minutes. Uncover blockchain data and invest smarter with Footprint.

The post As gaming guilds raise billions of dollars, who will be the next YGG? appeared first on CryptoSlate.