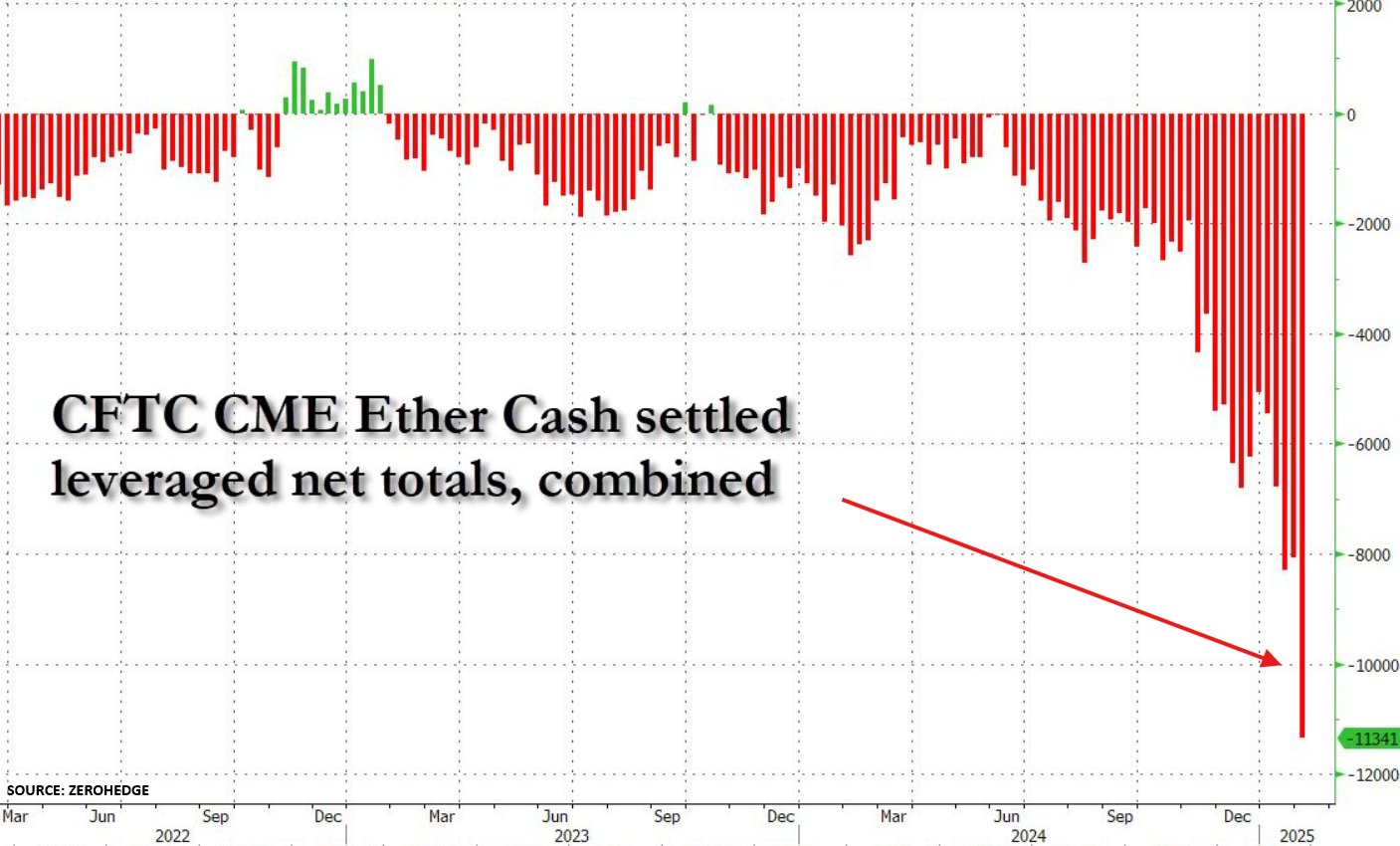

Ethereum (ETH), the second-largest cryptocurrency by reported market cap, is facing unprecedented short selling from hedge funds. Notably, short positions in ETH have soared by 500% since November 2024, indicating heightened bearish sentiment toward the digital asset.

Institutional Investors Losing Faith In Ethereum?

According to a recent post on X by The Kobeissi Letter, Ethereum price is witnessing mounting challenges as short positioning in the cryptocurrency has ballooned in recent times. Notably, ETH short positions are up 40% in the last week, while they are up 500% in the last three months.

It is worth highlighting that this is the highest level ever that Wall Street funds have been short Ethereum. Earlier this month, the crypto market got an indication of this bearish ETH positioning, as the digital asset crashed 37% in 60 hours amid Donald Trump’s proposed trade tariffs on Canada, China, and Mexico.

Interestingly, capital inflows to Ethereum exchange-traded funds (ETF) were significantly high in December 2024. In just 3 weeks, ETH ETFs attracted more than $2 billion in new funds, with a record breaking weekly inflow of $854 million.

However, hedge funds’ positioning on ETH suggests that they are not very confident in the cryptocurrency’s short-term price outlook. Several factors could be at play for institutional investor’s waning interest in ETH.

For instance, ETH is currently trading almost 45% below its current all-time high (ATH) of $4,878 recorded way back in November 2021. In contrast, Bitcoin (BTC) has had a stellar 2024, hitting multiple new ATH, and commanding a market cap that is almost six times larger than that of ETH.

The Kobeissi Letter attributes ETH’s current lacklustre price performance to potential “market manipulation, harmless crypto hedges, to bearish outlook on Ethereum itself.” However, the market commentator indicates that this excessive bearish outlook may set ETH up for a short squeeze. They add:

This extreme positioning means big swings like the one on February 3rd will be more common. Since the start of 2024, Bitcoin is up ~12 TIMES as much as Ethereum. Is a short squeeze set to close this gap?

ETH Short Squeeze To Initiate Altseason?

A short squeeze on ETH could teleport its price to as high as $3,000, or even $4,000. However, according to seasoned crypto analyst Ali Martinez, ETH must defend the $2,600 support level to climb higher.

Recent reports indicate that ETH has likely bottomed, paving the way for a trend reversal to the upside. Another report by Steno Research suggests that ETH is likely to outperform BTC in 2025, with potential targets as high as $8,000.

That said, concerns still remain about the Ethereum Foundation regularly dumping ETH. At press time, ETH trades at $2,661, up 0.1% in the past 24 hours.