Vignesh Sundaresan might not be a household name just yet. Still, the serial entrepreneur has made its mark in the crypto industry with a pseudonym that will certainly ring a bell—Metakovan.

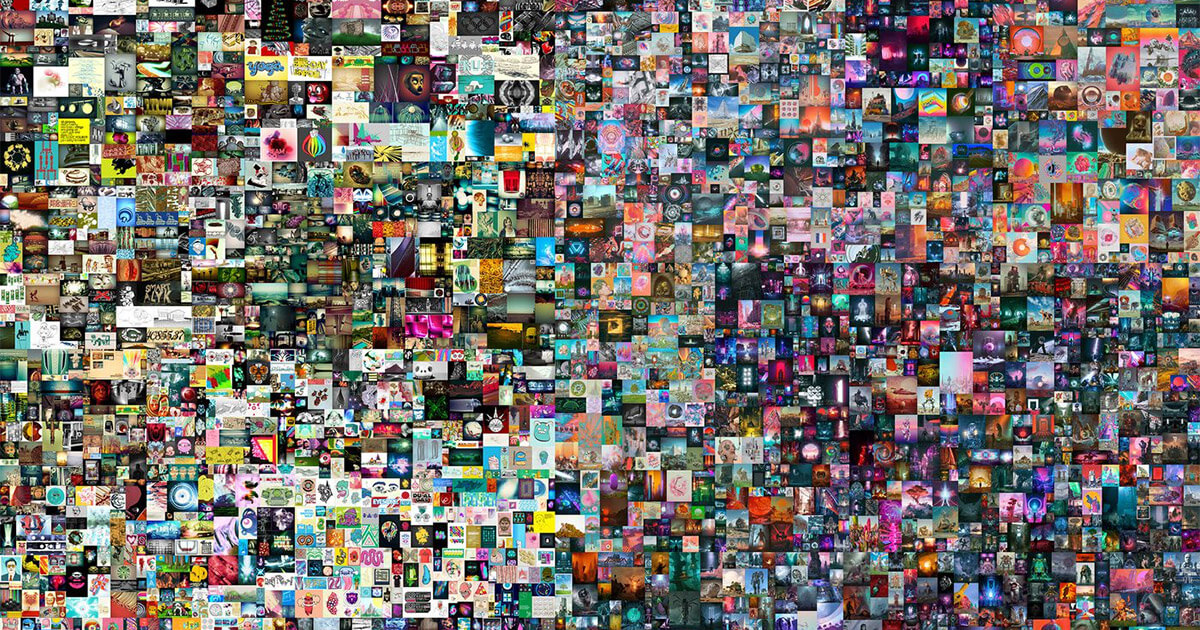

Almost exactly a year ago, Sundaresan bought the world’s most expensive NFT and the third most expensive piece sold by a living artist. His $69.3 million purchase of Beeple’s historic “Everydays: The First 500 Days” shocked the industry and was, at least in part, responsible for propelling NFTs into the mainstream.

The road to Beeple really is paved with good intentions

For months, the public tried to wrap its head around the purchase and figure out the identity of the person that now owned the world’s most expensive non-fungible token.

And while the identity of Metakovan, the pseudonym behind the purchase, was quickly revealed, the motivation behind the purchase remained largely unknown. In the days after the historical purchase, Sundaresan explained that part of his motivation to acquire Beeple’s work was to show Indians and people of color that they could become art patrons.

“Imagine an investor, a financier, a patron of the arts. Ten times out of nine, your palette is monochrome. By winning the Christie’s auction of Beeple’s Everydays: The First 5000 Days, we added a dash of mahogany to that color scheme,” he said at the time.

However, other factors were also at play.

In an interview with CryptoSlate, Sundaresan said he viewed the purchase as an investment in himself as he felt that he was making history.

“I’m happy to be part of the reason why NFTs are known worldwide. And to give back to the system that provided so much to me,” he told Anastasia Chernikova.

The wealth Sundaresan acquired in the crypto industry remains largely unknown. He notes that he only invests in projects he believes in and is only interested in the project’s success. The money, he believes, came as an afterthought.

He first got involved with the crypto industry all the way back in 2013, when he was looking for alternative ways to send money. Bitcoin, then a relatively obscure new type of currency, presented itself as a perfect solution to making money programmable.

After reaping success by offering escrow services for Bitcoin payments, Sundaresan founded Coins-e. The timing was perfect—the 2013 bull run brought in 14,000 users to the exchange in six months. By next summer, he sold the exchange for $160,000, which he quickly poured into another project. He co-founded BitAccess, a Y-Combinator-backed project that went on to install hundreds of Bitcoin ATMs around the world.

His quest for promising projects led him to Ethereum in 2016, when he invested a significant amount of money in its ICO.

“I was more interested in creating and impacting the world, and I was loyal to the technology. At that point, keeping the coins was about not waving my mind, but obviously, it seems like a smart decision now.”

“I never thought it would reach $100, much less $1,000. I wanted to be part of the community. I remember celebrating when ether was $15 because we thought that Ethereum had made it, not because we became rich. That’s the feeling that I still carry,” he said.

That same feeling will most likely prevent him from ever selling Beeple’s work, he later noted.

There’s also the factor of sentimental value—Sundaresan explained that the story behind Beeple’s work was what attracted him and led him to outbid Tron’s Justin Sun in the Christie’s auction.

“It was the labor of the work that attracted me more than the skill or talent or artistic potential,” he said of Beeple’s work, which contains 5,000 illustrations that were 13 years in the making. “It spoke to me because exactly 13 years ago I didn’t have any money. I started coding so I felt like it was similar to my journey – starting with nothing and ending up with something beautiful because of hard work. I appreciated it for that more than its artistic depth or anything else.”

The future of NFTs is bright and exciting

Aside from immense wealth, the rise of NFTs has also created a schism between its investors. First inhabited by a close-knit community from the art world, the NFT space now hosts a wide variety of investors, most of whom see them as a bottomless pit of money.

This has created an entirely new category of NFT projects—hype projects—which saw individual NFTs sold for tens of millions of dollars and billions in trading volume. These types of NFT projects are usually the ones that find their way into mainstream media, as news about pixelized Twitter profile images sold for $23 million tends to attract the most attention.

That attention, Sundaresan says, doesn’t benefit the wider NFT ecosystem. Instead, they paint a picture of exclusivity and make the space look like it’s only reserved for the richest, going against everything the industry stands for.

“I’m not a fan of Cryptopunks, the Yacht Club, and other PFP (photo-for-profile) projects. I don’t want to be part of exclusive clubs anymore. Instead, I want to be part of inclusive clubs and bring more people in and create a system where they get together and appreciate something. So I personally have stayed away from them.”

That doesn’t mean that there isn’t a segment of the market PFP projects were designed to fulfill. However, the projects themselves most likely won’t last through another crypto winter.

“There will be trends, and they will go, and other trends will arise. I think projects with unfair distribution are not permanent, and no one can stop the new and better projects, which will become more common. I am interested in the alternative to PFP projects.“

Despite his quest for fulfilling and promising projects, Sundaresan claims that even he’s not immune to FOMO.

“You cannot avoid FOMO even if you have everything in the world. FOMO is a state of mind.”

Any fears of missing out are quickly remedied, though. He notes that anytime he feels envious of the money being made in a hype project, he tries to see where the project will be in a few years.

“And if I don’t believe in it, I will sit it out,” he explained. “For example, I’ve never touched Cardano or Solano, because I don’t agree with their token distribution. And I might feel ‘oh, man, if I bought in, I would have made that money,’ but then I would have forgotten my principles.”

His principles state that not everything in the crypto industry should be seen as an investment—especially not NFTs. The trend of buying NFTs to make money off of them will change soon, he said, as the industry begins adding more utility to them. People will experience the art in their NFTs in many new ways as the asset class moves away from wallets and gets more intertwined with the real world.

Becoming a larger part of the real world will bring about a whole new set of problems, the biggest one being regulation. However, Sundaresan believes that any efforts to regulate the virtual NFT world will be futile, to say the least. The fast development pace we’ve all been accustomed to in the crypto industry means that it will be impossible for governments and regulators to catch up.

“It will take three years for regulators to put a law into force, and by then, the crypto community will already be doing something else. You can regulate the off-ramps and the on-ramps, which is fine. But banning something that you don’t understand is wrong. When politicians figure out how to regulate NFTs, something else will come up. And I have no idea what’s going to be next. Regulation has always lagged behind innovation, and I think that’s part of the design.”

This interview was conducted by Anastasia Chernikova, Editor-In-Chief of The Vivid Minds, a media dedicated to stories about how leaders overcome challenges and move forward.

The post The man who owns the world’s most expensive NFT appeared first on CryptoSlate.