NYDIG’s February report highlights how Ukrainian military support continues its influx by the millions as Russian Bitcoin transactions rise.

- $57 million have been donated for military support in Ukraine as of March 4.

- Russian Bitcoin transactions have increased as the BTC/RUB pair trades $62 million, but it does not seem to have affected the BTC price.

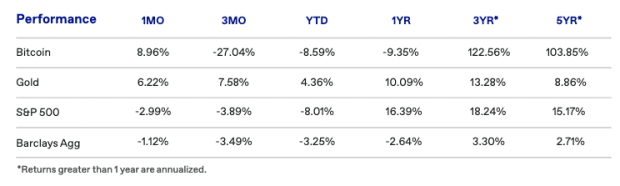

- Bitcoin is up roughly 9% for the month of February, coming back from the January dip and separating itself from other risk-on assets.

Ukrainians have embraced bitcoin for everyday purchases as its central bank cuts traditional payment rails.

NYDIG, a financial company that focuses on institutional-grade Bitcoin solutions, released its February 2022 Bitcoin Brief report discussing relevant statistics related to bitcoin as an asset, comparing it to other financial products, and diving into Bitcoin metrics in Ukraine as the Russian invasion perdures.

Speaking to cultural and geopolitical concerns, NYDIG’s report highlighted how “in just seven days, over 113,000 digital asset donations were sent directly to the government or an NGO providing support to the military.” As of March 4, the total value of donations reached $57 million, the report said.

Ukrainians have also been embracing bitcoin for everyday purchases as “the National Bank of Ukraine suspended the foreign exchange market, limited cash withdrawals, and prohibited the use of fiat currencies via digital platforms like Venmo or PayPal,” per the report.

As the invasion continues, NYDIG discussed the theories of Russian purchasing of bitcoin as a way to skirt sanctions saying, “Since the invasion began through March 4, the bitcoin / ruble pair has traded about $62 [million] in volume on Binance (Russia’s dominant crypto exchange), while the market cap of bitcoin has increased by $75 [billion].” They concluded this with, “These are not comparable numbers.”

Bitcoin was up around 9% in February, marking a deviation from the norm as other risk-on assets approached negative territory. This point was strengthened during January when bitcoin dipped along with other risk-on assets.