Multiple valuation models rooted in traditional financial data demonstrate that bitcoin is portfolio insurance for fixed-income investors.

Editor’s note: This article is the third in a three-part series. Plain text represents the writing of Greg Foss, while italicized copy represents the writing of Jason Sansone.

In the first two installments of this series, we reviewed many of the foundational concepts necessary for understanding the credit markets, both in “normal” times and during contagion. To conclude this series, we would like to explore a few methods by which one could arrive at a valuation for bitcoin. These will be dynamic calculations, and admittedly, somewhat subjective; however, they will also be one of many rebuttals to the oft-suggested claim by no-coiners that bitcoin has no fundamental value.

Prior to doing so, we want to state five foundational principles that underlie our thesis:

- Bitcoin = math + code = truth

- Never bet against open-source platforms

- Money has always been technology for making our expenditure of work/energy/time today available for consumption tomorrow

- Bitcoin is programmable monetary energy… A store of value, transferable on the world’s most powerful computer network

- Fiats are programmed to debase

Valuation Method One: The Fulcrum Index

I believe that bitcoin is the “anti-fiat.” As such, it can be thought of as default insurance on a basket of sovereigns/fiat currencies. This concept has a value that is fairly easily computed. We have coined this calculation the “fulcrum index,” and it indicates the cumulative value of credit default swaps (CDS) insurance on a basket of G20 sovereign nations multiplied by their respective funded and unfunded obligations. This dynamic calculation forms the basis of one current valuation method for bitcoin.

Why is bitcoin the “anti-fiat”? Put simply, it cannot be debased. The absolute supply is fixed. Forever. This is the exact opposite of the current global fiat currency regime. How, then, can it be considered “default insurance” on a basket of sovereigns/fiat currencies? Foundationally, insurance contract value increases as risk increases, and (credit) risk increases as fiat printing continues.

Let’s use the U.S. as a sample calculation. The federal government has over $30 trillion in outstanding debt. According to usdebtclock.org, at the time of this writing it also has $164 trillion of unfunded liabilities in Medicare and Medicaid obligations. Thus, the total of funded and unfunded obligations is $194 trillion. This is the amount of fiat that needs to be insured in the event of default.

At the time of this writing, the five-year CDS premium for the U.S. is priced at 0.12% (12 basis points, or bps). Multiplying this by the total debt obligations ($194 trillion), one arrives at the value of CDS default insurance of $232 billion. In other words, based upon data from the CDS market, that is the amount of fiat that the cumulative total of global investors would need to spend to buy default protection on the U.S. over the next five years.

If five-year CDS premia widen to 30 bps (to match Canada at the time of this writing), the value increases to $570 billion. Note: This calculation uses a fixed five-year term. That said, the outstanding weighted-average obligation is longer than five years, due to Medicare and Medicaid, and consequently we have decided to extrapolate to a term of 20 years. Using a tenor calculation, the implied 20-year CDS premium for the U.S. is 65 bps. In other words, just using the U.S. as one component in the G20 basket, we have a valuation of $194 trillion multiplied by 65 bps = $1.26 trillion.

If we now expand to a broader view, our calculation of the current G20 fulcrum index is over $4.5 trillion.

Regardless, by this methodology, a fair value for bitcoin is about $215,000 per bitcoin today. Note: This is a dynamic calculation (since the input variables are continuously changing). It is somewhat subjective, but is based upon valid benchmarks using other clearly-observed CDS markets.

At a current price of approximately $40,000 per bitcoin, the fulcrum index would indicate that bitcoin is very cheap to fair value. As such, given that every fixed income portfolio is exposed to sovereign default risk, it would make sense for every fixed income investor to own bitcoin as default insurance on that portfolio. It is my contention that as sovereign CDS premia increase (reflecting increased default risk) the intrinsic value of bitcoin will increase. This will be the dynamic that allows the fulcrum index to continually revalue bitcoin.

Valuation Method Two: Bitcoin Vs. Physical Gold

Bitcoin has been called “Gold 2.0” by some. The argument for this is beyond the scope of this article. Regardless, the market capitalization of physical gold is approximately $10 trillion. If we divide that amount by the 21 million hard-capped supply of bitcoin, the result is about $475,000 per bitcoin.

Valuation Method Three: Bitcoin As A Percentage Of Global Assets

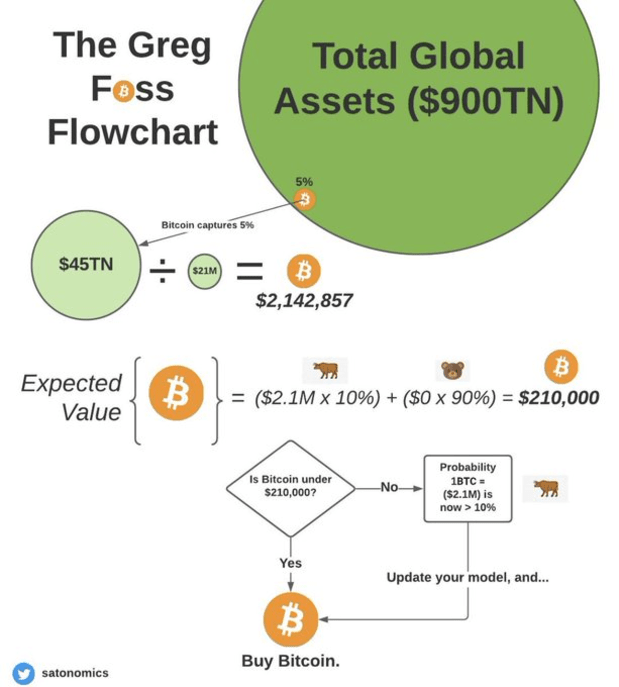

According to my recollection, the Institute for International Finance estimated the total global financial assets in 2017, including real estate, to be $900 trillion. If bitcoin were to capture 5% of that market, we could calculate $45 trillion divided by 21 million to find a value of $2.14 million per bitcoin, in today’s dollars. At 10% market share, it is over $4 million per bitcoin.

Valuation Method Four: Expected Value Analysis

On an expected value basis, bitcoin is also cheap, and, with each day that the Bitcoin network survives, the left-hand side (toward zero) of the probability distribution continues to decrease while the right-hand side asymmetry is maintained. Let’s do a simple analysis using the numbers calculated above. We will formulate a distribution that has only five outcomes, with arbitrarily assigned probabilities.

The expected value outcome from this example is over $150,000 per bitcoin.

Given recent price levels of bitcoin, if you believed this to be aligned with your expected value calculation, you would be buying with both hands. Of course, there is no certainty that I am right. And this is not financial advice to run out and buy bitcoin. I am simply presenting a valuation methodology that has served me well in my 32-year career. Do. Your. Own. Research.

For the record, my base case is substantially higher than this, as I believe there is a real chance bitcoin becomes the reserve asset of the global economy. The tipping point for that event is when bitcoin is adopted as a global unit of account for the trade of energy products. I believe it is logical for countries who are selling their valuable energy resources in return for worthless fiat to move from the U.S. dollar to bitcoin. Interestingly, Henry Ford foreshadowed this when he declared long ago that he would displace gold as the basis of currency and substitute in its place the world’s imperishable natural wealth. Ford was a Bitcoiner before Bitcoin existed.

Digital monetary energy stored on the world’s largest and most secure computer network in return for energy to power electrical grids across the globe is a natural evolution built upon the first law of thermodynamics: conservation of energy.

Conclusion

These are huge numbers, and they clearly show the asymmetric return possibilities of the bitcoin price curve. In reality, the probability/price distribution is continuous, bounded at zero with a very long tail to the right. Given its asymmetric return distribution, I believe it is riskier to have zero exposure to bitcoin than it is to have a 5% portfolio position. If you are not long bitcoin, you are irresponsibly short.

If you are a fixed income investor today, the math is not in your favor. The current yield to maturity on the “high yield” index is approximately 5.5%. If you factor in expected and unexpected losses (due to default), add in a management expense ratio and then account for inflation, you are left with a negative real return. Put simply, you are not earning an appropriate return on your risk. The high-yield bond market is headed for a major reckoning.

Don’t overthink this. Lower your time preference. Bitcoin is the purest form of monetary energy and is portfolio insurance for all fixed-income investors. In my opinion, it is cheap on most rational expected value outcomes. But again, you can never be 100% certain. The only things that are certain:

- Death

- Taxes

- Ongoing fiat debasement

- A fixed supply of 21 million bitcoin

Study math people… or end up playing stupid games and winning stupid prizes. Risk happens fast. Bitcoin is the hedge.

Epilogue

It would seem that everyone should understand the basics of the credit-based monetary system upon which our governments and countries run. If we are to uphold the ideals of a democratic republic (as Lincoln declared: “… a government of the people, by the people, for the people”), then we must demand transparency and integrity from those among us whom we have selected as leaders. This is our duty as citizens: to hold our leadership accountable.

But we cannot do that if we don’t understand what it is they are doing in the first place. Indeed, financial literacy is severely lacking in the world today. Sadly, it would appear that this is by design. Our public education systems have 12 years to teach, and thus, empower us to think critically and question the status quo. It is through this process of societal empowerment that we strive for, and collectively achieve, a better future.

Yet, this is the same process by which we remove the centrality of power. And that, make no mistake, is a threat to those who sit atop the system. Often, this power is concentrated in the hands of a select few (and stays that way) due to a knowledge disparity. Thus, we find it tragic that an article such as this even needs to be written… Perhaps, though, the greatest gift Satoshi gave the world was to reignite the fire of curiosity and critical thought within all of us. This is why we Bitcoin.

Never stop learning. The world is dynamic.

This is a guest post by Greg Foss and Jason Sansone. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.