The world is marching on toward the mass adoption of cryptocurrencies. This is evident in almost every metric one can look at when analyzing the crypto market, even in volatile times and during sharp downturns.

Venture capital investments in crypto have surpassed $30 billion, with more than $10.5 billion invested in the last quarter of 2021 alone. Alongside institutions, retail investors have also begun realizing the potential of crypto and are flocking to it in record numbers.

To find out more about what makes the crypto market tick and get an understanding of the broad makeup of its participants, Gemini conducted an ambitious survey of 30,000 people across 20 countries. The survey explored awareness of cryptocurrencies and crypto companies, the motivations for buying and trading, as well as barriers to owning cryptocurrencies.

What the survey found was that 2021 was crypto’s breakout year—there have never been more people entering the market, more people interested in entering the market, and more people realizing the potential of cryptocurrencies.

Identifying crypto curiosity and crypto ownership

While it’s easy to quantify current market performance, predicting its future performance depends on a multitude of factors—the biggest being its participants.

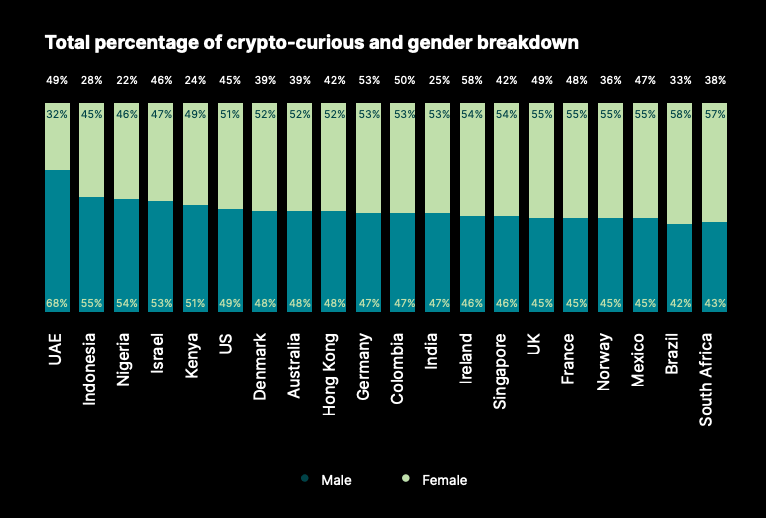

Gemini set out to discover just how much untapped potential there is outside of the crypto market by surveying people about their general curiosity about cryptocurrencies. According to the report, 41% of its global respondents said that they were crypto-curious. This means that they currently don’t own cryptocurrencies but plan on buying in the next year.

Diving deeper into the geographic makeup of the crypto-curious reveals that a significant number of them come from Europe. Ireland led among the crypto-curious, both globally and in Europe, with 58% saying they were interested in purchasing cryptocurrencies in the near future. A significant number of crypto-curious respondents came from Germany, Colombia, and the United Arab Emirates—53%, 50%, and 49%, respectively.

The data shows that the majority of the crypto-curious come from developed nations with stable financial systems, with the exception of Colombia.

This, however, isn’t the case when it comes to crypto ownership.

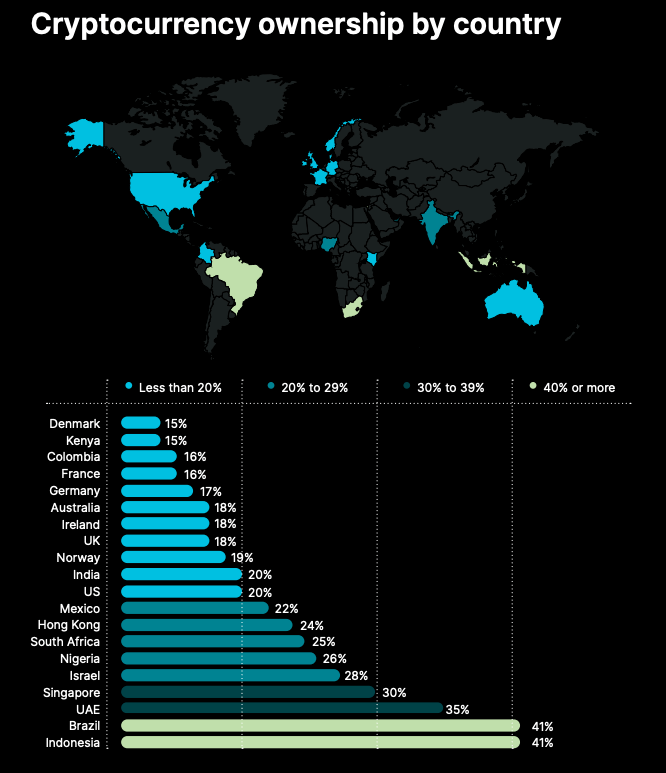

Gemini’s data shows that the least amount of ownership comes from developed nations—15% in Denmark, 16% in France, 17% in Germany, 18% in Australia, 18% in the U.K., and 19% in Norway. The exceptions to the rule are Kenya and Colombia, where only 15% and 16% of respondents owned crypto.

The largest crypto ownership was identified in Brazil and Indonesia, where 41% of respondents said they owned cryptocurrencies. Approximately a third of respondents from Singapore and the U.A.E. owned crypto, while the ownership decreased to around a quarter in Israel, Nigeria, South Africa, Hong Kong, and Mexico.

Crypto is the future of money for many

The extremely high rate of crypto ownership in certain countries can be attributed to several correlating factors. People in countries with the highest adoption and the highest percentage of crypto curiosity tend to see cryptocurrencies as the future of money.

This is due to the fact that these countries have seen their national currencies devaluate against the dollar over the past decade, drastically affecting both the quality of life and financial stability. Respondents in countries with 50% or more devaluation against the dollar over the past 10 years were more than 5 times more likely to say they plan to purchase crypto in the coming year, compared to those who experienced less than 50% inflation.

A significant number of respondents saw cryptocurrencies as a way to protect against inflation—46% of respondents in Latin America and Africa said they were looking into the asset class as a way to offset currency devaluation.

In regions where the local currency hasn’t experienced significant long-term devaluation, respondents were far less likely to see cryptocurrencies as a hedge against inflation—just 15% in Europe and 16% in the United States.

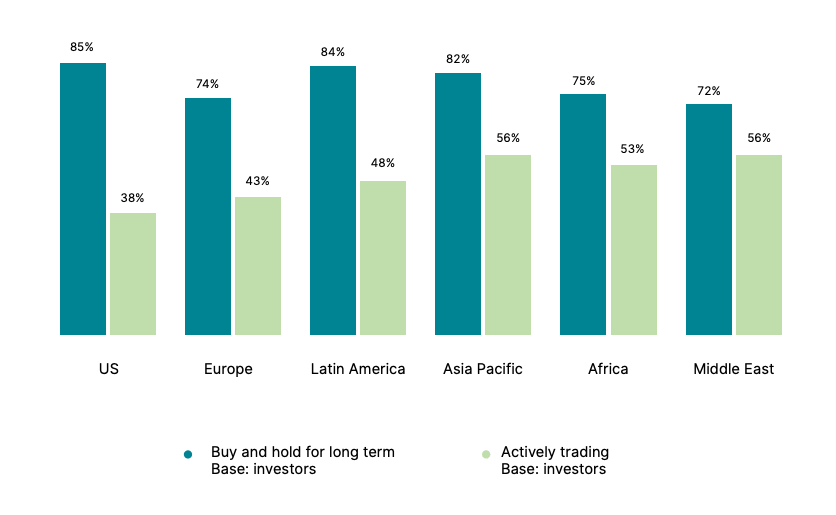

But, no matter the location, the vast majority of crypto owners said they saw cryptocurrencies as a store of value. Just under 80% of respondents across all regions said they saw long-term investment potential in the cryptocurrencies they owned. That doesn’t mean that they eschew trading, as just over half of crypto owners in Asia Pacific, Africa, and the Middle East reported actively trading crypto for profit.

However, the high rate of adoption and general confidence in the crypto market this data shows doesn’t paint the full picture.

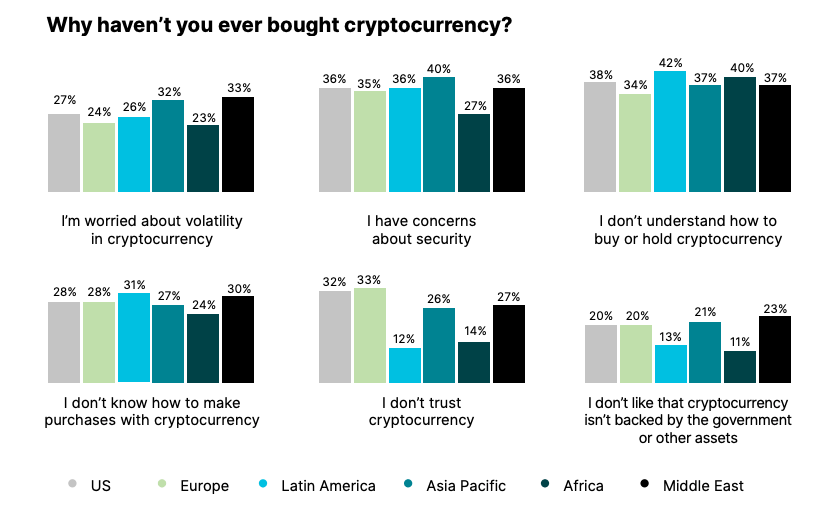

Those planning on purchasing cryptocurrencies identified several major barriers that have prevented them from entering the market and will prevent them from participating in it in the future.

According to the report, the majority of respondents said they had concerns about trust, volatility, and security. Many said that a lack of understanding around how to make purchases and store the crypto they purchase was also a major concern.

Regulation is also a major concern for those looking to enter the crypto market. Among non-owners, 39% in the Asia Pacific, 37% in Latin America, and 36% in Europe say there is legal uncertainty around cryptocurrency. Uncertainty also surrounds taxation, with 30% of respondents in the Middle East, 24% in the Asia Pacific, and 23% in Latin America saying the tax complexities of owning cryptocurrency have kept them from investing in crypto.

Education + regulation = adoption

Despite a significant amount of concern prospective crypto owners feel, the data from Gemini’s survey confirms what most already see—there’s a tingling sensation in the market and it isn’t going away anytime soon.

Last year was a breakout year for cryptocurrencies as it saw the biggest influx of new users. It also saw the biggest increase in the number of people considering entering the market, which can be seen as a good indicator of future performance.

The economic downturn caused by the COVID-19 pandemic sped up ongoing inflation around the globe, further destabilizing flimsy economies. All of this has pushed even more people to consider cryptocurrencies, as quick currency devaluation threatens to wipe out savings and cause even further economic turmoil.

Crypto confidence increased even more in countries with unstable governments as people began to lose their trust in institutions and see decentralized systems like cryptocurrencies as a more stable investment.

Where cryptocurrencies were subjected to most regulation, the market has seen slower growth and an overall smaller percentage of prospective owners. Those that owned crypto in those markets, however, tend to own more of it and offset the overall lack of market participants.

While we are yet to see whether these trends continue into the following year, these trends, identified in Q4 2021, seem to be corroborated by current market performance. If the global crypto market continues to seek clearer regulation and invest in educating the crypto-curious, we could see adoption soar.

The post This is why 2021 was crypto’s breakout year appeared first on CryptoSlate.