The prime objective of DeFi is to create an open finance market wherein the role of centralized financial intermediaries will be minimized to ensure faster financial transactions with zero paperwork. To attain this objective, significant developments are being constantly added to the DeFi protocol for its advancement.

Owing to such developments, the DeFi industry is gaining widespread popularity as an investment option. With more and more DeFi coins entering the digital asset market, it gets confusing for investors to know about their utilities and potential in the future. We have explained below some of the top DeFi Coins to help you understand their advantages and the underlying protocol.

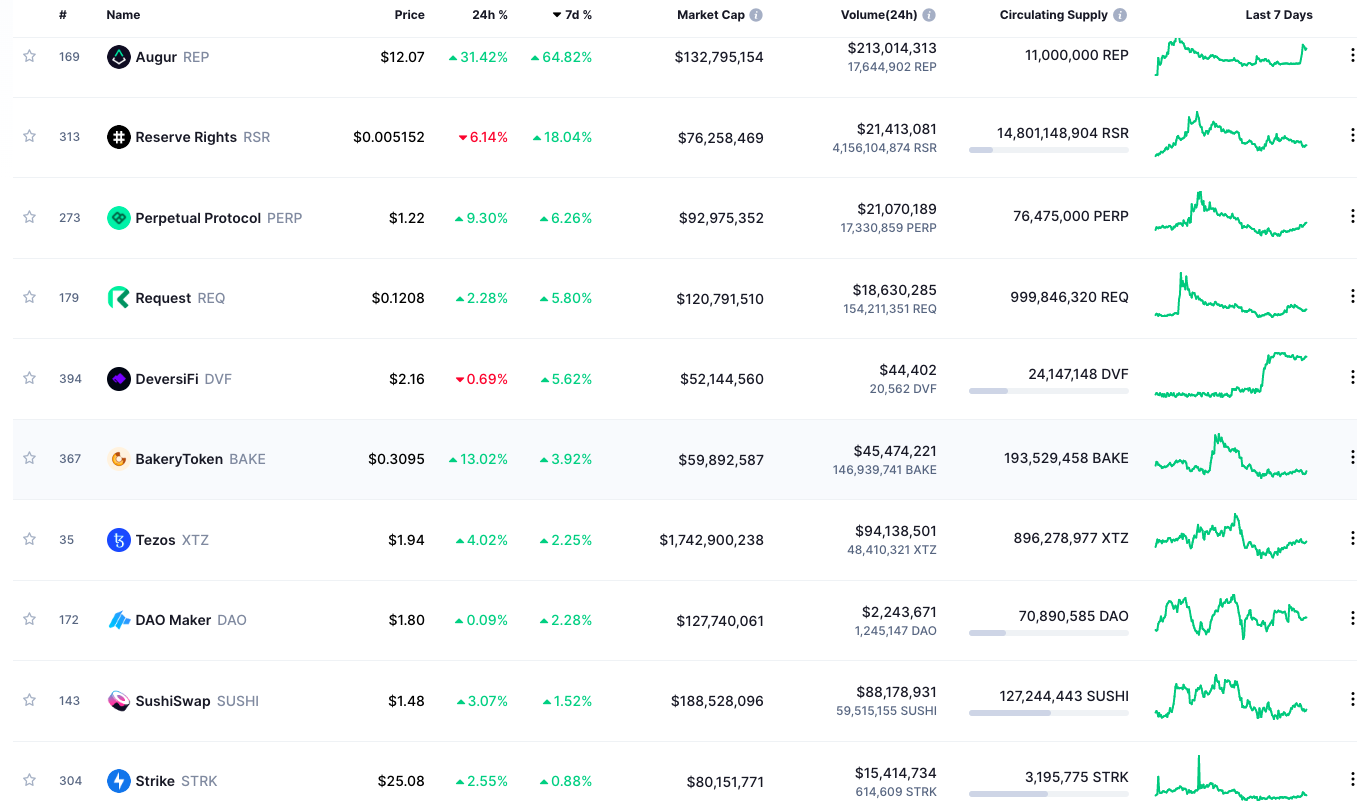

10 Top Defi Coins based on 7 Days Price Movement:

1. Augur (REP)

Augur is a decentralized prediction market platform built on the Ethereum blockchain. On this platform, instead of trading in cryptos, users can trade on the wager of events. They lose or gain according to the outcome of the event. Users are rewarded when they predict an outcome correctly.

REP is the native token that can be used to create a prediction market on the platform, purchase tokens for participation in the wager and dispute the outcome of an event. The rewards earned on this platform are paid in REP. However, traders do not need to hold REP to bet on the platform.

The current market price of REP is $1.23 with a market cap of $94,291,956. The 24 h trading volume of the coin is $21,009,592. It has 11,000,000 coins in circulation and a total supply of 11 million coins.

Your capital is at risk.

2. Reserve Rights (RSR)

The Reserve Protocol hosts a decentralized stablecoin named RT Token. Stablecoins are digital assets whose value will not be affected by external factors like government measures, wars, etc. Users can convert their local currencies into digital dollars to safeguard their funds from the risk of inflationary impacts.

Reserve Rights (RSR) is an ERC-20. Being the governance token of the platform, it provides the holders with the right to propose changes and vote on changes relating to the protocol’s configuration. It can also be staked to insure the RT token.

The current market price of RSR is $0.005 with a market cap of $79,113,084. Its 24 h trading volume is $21,348,306. The max supply of the coin is 100 billion and the current circulation is 14.8 billion.

Your capital is at risk.

3. Perpetual Protocol (PERP)

Perpetual Protocol is a decentralized exchange for executing perpetual contracts. Using these perpetual contracts, users can long or short on a wide range of crypto assets and use up to 10x leverage. It aims to build a secure and easily-accessible decentralized derivative trading platform.

PERP token powers the Perpetual Platform. It can be used for staking and governance as well. The current market price of the coin is $1.23 with a market cap of $94,291,956. The last 24 h trading volume is $21,009,592.

Your capital is at risk.

4. Request (REQ)

Request Network is a decentralized payment gateway system, wherein users can request and receive money in a secured way in the form of cryptos. It supports all global currencies and does away with the need for a centralized third party to execute transactions. The transaction fee charged by the platform is very nominal.

The REQ is the native token of the Request protocol that facilitates anti-spam, staking, product discounting, and independency of operations on the Request Network. It is also the governance token qualifying holders for voting rights in the governing process.

The current market price of REP is $0.1243.

Your capital is at risk.

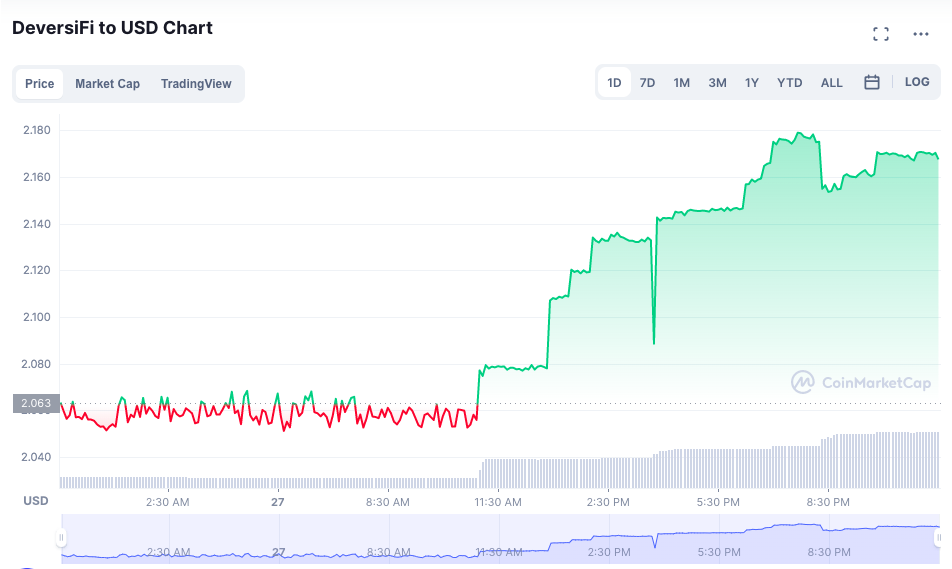

5. DeversiFi (DVF)

DeversiFi is a DeFi platform wherein traders can manage all their crypto holdings under one roof. Investors can search for the best interest-earning investment opportunities on this platform without having to explore different exchanges. It does not charge ETH gas fees.

It is powered by the DVF (ERC 20) token. Holders can stake their DVF tokens to receive xDVF tokens. It is also the governance token of the platform thus giving the holders a say in the governance process.

Its current market price is $2.17 and its 24-hour trading volume is $45,518. It currently enjoys a market capitalization of $52,458,289. It has 24.14 million coins in circulation and a maximum supply of 100 million coins.

Your capital is at risk.

6. BakerToken (BAKE)

BAKE token is a part of BakerySwap ecosystem, which is an automated market-making protocol built on the Binance Smart Chain. It offers liquidity pools for various altcoins.

BAKE is a native BEP-20 token of the platform. Users can earn BAKE rewards for providing liquidity to the platform. It is also a governance token that provides voting rights and a share in the transaction fees of the platform.

Its current market price is $0.313 and its 24-hour trading volume is $51.53 million. It currently enjoys a market capitalization of $60,733,370. It has 193.52 coins in circulation and a maximum supply of 289.77 million coins.

Your capital is at risk.

7. Tezos (XTZ)

Tezos is an open-source blockchain platform for deploying smart contracts and facilitating P2P transactions. The platform claims to offer the accuracy required for high-value use cases and advanced infrastructure that is better than ETH and BTC blockchain.

It also focuses on introducing upgradation and developments in the platform overtime to make it highly compatible with the ever-changing Blockchain technology.

XTZ is the native token that has multiple usages within the platform. It is used to interact with dApps, pay for transaction fees, and secure the network through staking. XTZ is also the basic accounting unit of the platform (denomination).

XTZ has a floor price of $1.99 and a 24 hr trading volume of $86,139,325. The market cap of the coin is $1,786,287,924. There are 896,278,977 XTZ coins in supply at present and the total supply is 917.84 million.

Your capital is at risk.

8. DAO Maker (DAO)

DAO Maker is a decentralized investment platform built on the Blockchain, through which retail venturers can invest in startups and other business projects. The platform works as an intermediary between the investors and the startups during the fund-raising process. It saves investors from the risk of fraud as the payments are routed through the platform to reach the projects or startups.

DAO token is the native utility and governance token of the platform. It can be used for performing a variety of transactions within the platform. It is a deflationary token and the platform offers huge rewards for DAO staking to its holders.

It is currently trading at a price of $1.81, with a 24-hour trading volume of $1,595,630. It currently has a market capitalization of $128,195,909. It has 70.89 coins in circulation and a total supply of 312 million coins.

Your capital is at risk.

9. SushiSwap (SUSHI)

SushiSwap is an ETH-built platform that works as a decentralized cryptocurrency platform that facilitates the selling and buying of cryptos without the need for a centralized crypto exchange. It makes use of a liquidity pool wherein users lock up their crypto holdings for a specific period for which the traders can buy and sell crypto as per their demands.

SUSHI is the native token that powers the platform. All rewards for crypto staking into the liquidity pool of the platform are paid in SUSHI. SUSHI holders also enjoy voting rights relating to the governance of the platform.

SUSHI is currently trading at a price of $1.49 with a 24h trading volume of $88,347,284. The market cap of the coin is $190,142,021. The circulating supply is 127.24 million and the max supply is capped at 250 million coins.

Your capital is at risk.

10. Strike (STRK)

Strike is a DeFi lending protocol. It supports various lending markets known as the Strike markets. Users can choose to deposit their crypto holdings on any of the Strike markets and receive sToken in return. Users can also take loans from any of the Strike pools by depositing collateral.

The Strike Protocol is financed by the STRK token. It can be staked on the platform to participate in liquidity mining. It is also the governance token of the platform.

STRK’s current floor price is $24.93 on major exchanges. The 24h trading volume is $16,006,096 and the market cap is $79,658,240. The max supply of the coin is 6,540,888 out of which 3,195,774.92 are in circulation.

Your capital is at risk.

What is the Best Place to Buy DeFi Coins?

If you are looking to buy DeFi Coins, then the best platform is eToro. Because it is a highly regulated and safe platform with the cheapest fee structure. You can start your trading journey with just a spend of $10 (US/UK residents).

Those who have no knowledge about DeFi Coins can use its copy portfolio to copy the trade allocation of successful investors on the platform. Or, they can make use of its smart DeFi Portfolio. This portfolio offers investors instant diversification into several key DeFi crypto assets like Uniswap, Chainlink, AAVE, Compound, YFI, MKR, ALGO, and more.

Read more:

Lucky Block – Our Recommended Crypto of 2022

- New Crypto Games Platform

- Featured in Forbes, Nasdaq.com, Yahoo Finance

- Worldwide Competitions with Play to Earn Rewards

- LBLOCK Token Up 1000%+ From Presale

- Listed on Pancakeswap, LBank

- Free Tickets to Jackpot Prize Draws for Holders

- Passive Income Rewards

- 10,000 NFTs Minted in 2022 – Now on NFTLaunchpad.com

- $1 Million NFT Jackpot in May 2022